Table Of Content

A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money. Young homebuyers are twice as likely to use family money for a down payment as they were five years ago, according to a new report from Redfin. In fact, 36% of Gen Zers and Millennials who plan to buy a home expect to receive support from family to help fund their down payment.

Best Mortgage Lenders

You can buy a home with no money down if you qualify for a Department of Veterans Affairs (VA) loan or a U.S. VA loans are mortgage loans for current and former military personnel and surviving spouses who meet the VA’s criteria. USDA loans are mortgage loans for homes in qualifying rural and suburban areas.

How To Save for Down Payment

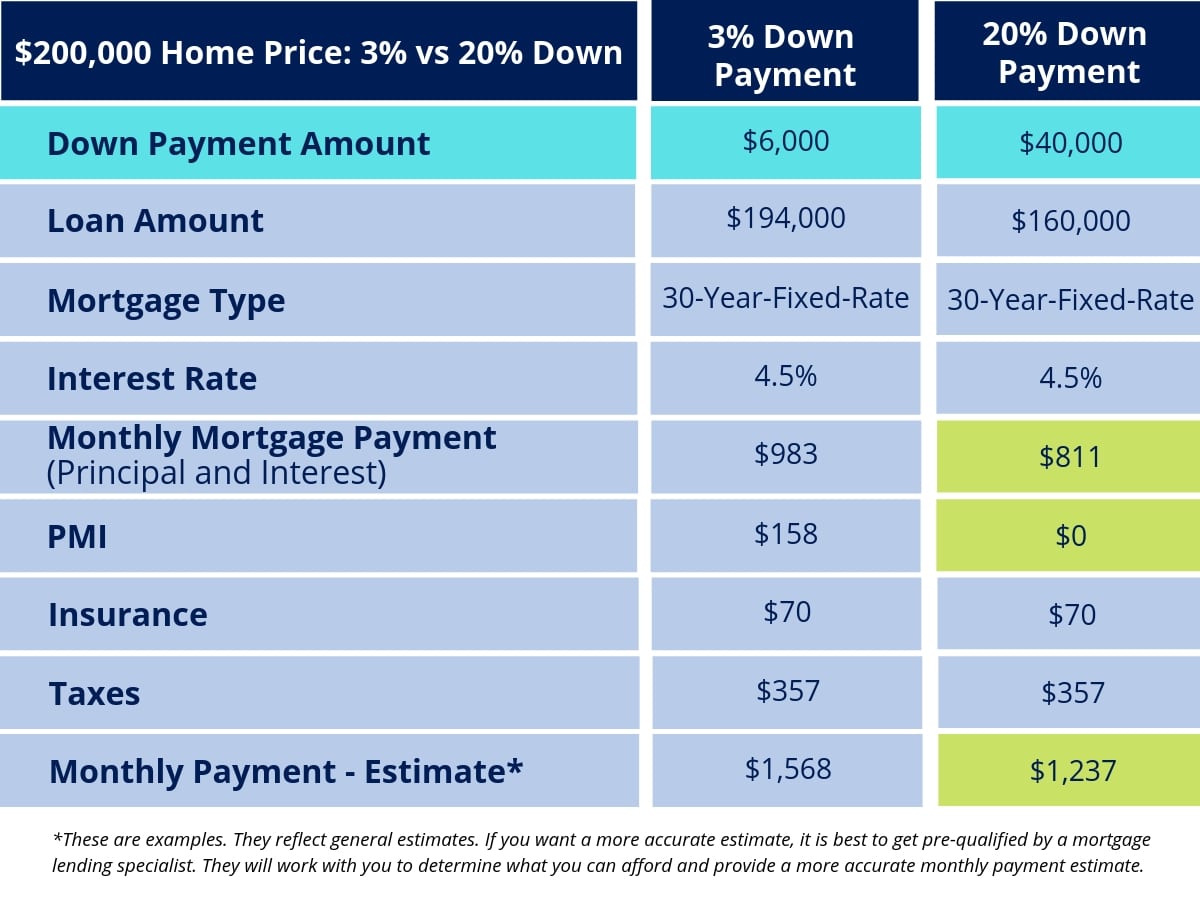

This value pays the total sum of your debts, including your mortgage. The average first-time home buyer pays 6% upfront and obtains a mortgage from a bank or other financial institution for the balance. PMI can be a helpful tool to make homeownership a reality for anyone who might struggle to save a 20% down payment.

Down payments up 10% for Metro Detroit homebuyers - Axios

Down payments up 10% for Metro Detroit homebuyers.

Posted: Wed, 24 Apr 2024 10:29:56 GMT [source]

Median down payment on a house (in dollars)

A second home is a residence you occupy in addition to your primary residence. The property can be a vacation home or a home you visit regularly. If you put down less than 20%, you can ask your lender to remove PMI once you’ve reached 20% equity in your home. Before deciding on the size of your down payment, weigh the pros and cons of a large down payment to see what will work best for your finances and goals.

Most assistance comes in the form of first-time home buyer grants and loans offered at the state and local levels. Funds may even be available from the private sector and nonprofits where you live. Your approval amount will give you an idea of the closing costs you’ll pay. Most government and charity programs have strict definitions for who qualifies as a first-time home buyer.

About 60% of respondents in the Redfin study said they save directly from their paychecks, and 39% are likely working a second job to afford a home in the future. Mortgage interest is the cost you pay your lender each year to borrow their money, expressed as a percentage rate. Unless you can wrap your closing costs into your loan, you must pay these upfront. Similarly, almost three-quarters of down payment assistance programs have income limits, although 27% allow applicants of any earning level to qualify. First-time and lower-income homebuyers have some conventional options for 3% down.

Use the Home Price and Upfront Cash Available

As an example, for a $250,000 home, a down payment of 3.5% is $8,750, while 20% is $50,000. Matched savings programs – otherwise known as individual development accounts – are another way for homeowners to get help on their down payment. With these home buyer programs, prospective home buyers deposit money into an account with a bank, government agency or community organization. Buyers can then use the total amount of funds to help cover their down payments. The amount you’ll need will vary, and some mortgage programs don’t require a down payment at all. Coming up with this upfront cash may not be super-easy for everyone, which is why down payment assistance grants, loans and programs were created to help first-time buyers.

Make Saving Easy

U.S. military service personnel, veterans, and their families can qualify for zero-down loans backed by the U.S. Other benefits include a cap on closing costs (which may be paid by the seller), no broker fees, and no MIP. VA loans require a “funding fee,” a percentage of the loan amount that helps offset the cost to taxpayers. The funding fee varies depending on your military service category and loan amount.

Virginia Beach accountant pleads guilty to…

Deciding on Your Home Down Payment: a Comprehensive Guide - Business Insider

Deciding on Your Home Down Payment: a Comprehensive Guide.

Posted: Thu, 14 Mar 2024 07:00:00 GMT [source]

In addition, borrowers risk losing their down payment if they can't make payments on a home and end up in foreclosure. As a result, down payments act as an incentive for borrowers to make their mortgage payments, which reduces the risk of default. Down payment assistance helps you cover your down payment as a first-time home buyer. When you buy a home, you’ll usually have to put money down that’s equal to a percentage of your home’s final purchase price.

Approximately 94% of this age group obtained financing while having a median down payment of 8%. For instance, the average median down payment was $34,248 in Q2 2023, down 3.3% year-over-year from $35,410. The median sales price decreased by 7.4% from $449,300 to $416,100 over a similar period. The nationwide average down payment for a house is 14.4%—an average median of $34,248—during the second quarter of 2023, reports Hannah Jones, an economic data analyst at Realtor.com. Here, we look at the average down payment for a house across the U.S. and how to afford a home loan. See if you qualify for these ways to help you stretch your savings.

Miranda Crace is a Senior Section Editor for the Rocket Companies, bringing a wealth of knowledge about mortgages, personal finance, real estate, and personal loans for over 10 years. Miranda is dedicated to advancing financial literacy and empowering individuals to achieve their financial and homeownership goals. She graduated from Wayne State University where she studied PR Writing, Film Production, and Film Editing.

For instance, you may start by transferring a portion of each paycheck into a savings account. Saving for a down payment can be overwhelming since it’s a considerable cost. Here are several tips and tricks to find the funds you need to buy a house. Our partners cannot pay us to guarantee favorable reviews of their products or services.

A mortgage pre-approval is an official step where a lender verifies your financial information and credit history. Your mortgage application collects information regarding your estimated down payment amount, income, employment, debts, assets, credit report, and credit score. In general, you may qualify for a better interest rate with a higher down payment, which reduces the overall cost of your mortgage over time.

With a passion for finance, real estate and travel, Samantha has written hundreds of articles to help others use money as a tool to live their dream life. Samantha is a proud 2X West Chester University alum and is based in Pennsylvania. The median US home price has spent the past few years hovering right above $400,000, leading many prospective buyers to wonder precisely what it takes to get into such a property. 401(k)—It is possible to take out a loan for either up to $50,000, or half the value of the 401(k) account, whichever is less.

No comments:

Post a Comment